89 Categorizing Public Policy

Learning Outcomes

By the end of this section, you will be able to:

- Describe the different types of goods in a society

- Identify key public policy domains in the United States

- Compare the different forms of policy and the way they transfer goods within a society

The idea of public policy is by its very nature a politically contentious one. Among the differences between American liberals and conservatives are the policy preferences prevalent in each group. Modern liberals tend to feel very comfortable with the idea of the government shepherding progressive social and economic reforms, believing that these will lead to outcomes more equitable and fair for all members of society. Conservatives, on the other hand, often find government involvement onerous and overreaching. They feel society would function more efficiently if oversight of most “public” matters were returned to the private sphere. Before digging too deeply into a discussion of the nature of public policy in the United States, let us look first at why so many aspects of society come under the umbrella of public policy to begin with.

DIFFERENT TYPES OF GOODS

Think for a minute about what it takes to make people happy and satisfied. As we live our daily lives, we experience a range of physical, psychological, and social needs that must be met in order for us to be happy and productive. At the very least, we require food, water, and shelter. In very basic subsistence societies, people acquire these through farming crops, digging wells, and creating shelter from local materials. People also need social interaction with others and the ability to secure goods they acquire, lest someone else try to take them. As their tastes become more complex, they may find it advantageous to exchange their items for others; this requires not only a mechanism for barter but also a system of transportation. The more complex these systems are, the greater the range of items people can access to keep them alive and make them happy. However, this increase in possessions also creates a stronger need to secure what they have acquired.

Economists use the term goods to describe the range of commodities, services, and systems that help us satisfy our wants or needs. This term can certainly apply to the food you eat or the home you live in, but it can also describe the systems of transportation or public safety used to protect them. Most of the goods you interact with in your daily life are private goods, which means that they can be owned by a particular person or group of people, and are excluded from use by others, typically by means of a price. For example, your home or apartment is a private good reserved for your own use because you pay rent or make mortgage payments for the privilege of living there. Further, private goods are finite and can run out if overused, even if only in the short term. The fact that private goods are excludable and finite makes them tradable. A farmer who grows corn, for instance, owns that corn, and since only a finite amount of corn exists, others may want to trade their goods for it if their own food supplies begin to dwindle.

Proponents of free-market economics believe that the market forces of supply and demand, working without any government involvement, are the most effective way for markets to operate. One of the basic principles of free-market economics is that for just about any good that can be privatized, the most efficient means for exchange is the marketplace. A well-functioning market will allow producers of goods to come together with consumers of goods to negotiate a trade. People facilitate trade by creating a currency—a common unit of exchange—so they do not need to carry around everything they may want to trade at all times. As long as there are several providers or sellers of the same good, consumers can negotiate with them to find a price they are willing to pay. As long as there are several buyers for a seller’s goods, providers can negotiate with them to find a price buyers are willing to accept. And, the logic goes, if prices begin to rise too much, other sellers will enter the marketplace, offering lower prices.

A second basic principle of free-market economics is that it is largely unnecessary for the government to protect the value of private goods. Farmers who own land used for growing food have a vested interest in protecting their land to ensure its continued production. Business owners must protect the reputation of their business or no one will buy from them. And, to the degree that producers need to ensure the quality of their product or industry, they can accomplish that by creating a group or association that operates outside government control. In short, industries have an interest in self-regulating to protect their own value. According to free-market economics, as long as everything we could ever want or need is a private good, and so long as every member of society has some ability to provide for themselves and their families, public policy regulating the exchange of goods and services is really unnecessary.

Some people in the United States argue that the self-monitoring and self-regulating incentives provided by the existence of private goods mean that sound public policy requires very little government action. Known as libertarians, these individuals believe government almost always operates less efficiently than the private sector (the segment of the economy run for profit and not under government control), and that government actions should therefore be kept to a minimum.

Even as many in the United States recognize the benefits provided by private goods, we have increasingly come to recognize problems with the idea that all social problems can be solved by exclusively private ownership. First, not all goods can be classified as strictly private. Can you really consider the air you breathe to be private? Air is a difficult good to privatize because it is not excludable—everyone can get access to it at all times—and no matter how much of it you breathe, there is still plenty to go around. Geographic regions like forests have environmental, social, recreational, and aesthetic value that cannot easily be reserved for private ownership. Resources like migrating birds or schools of fish may have value if hunted or fished, but they cannot be owned due to their migratory nature. Finally, national security provided by the armed forces protects all citizens and cannot reasonably be reserved for only a few.

These are all examples of what economists call public goods, sometimes referred to as collective goods. Unlike private property, they are not excludable and are essentially infinite. Forests, water, and fisheries, however, are a type of public good called common goods, which are not excludable but may be finite. The problem with both public and common goods is that since no one owns them, no one has a financial interest in protecting their long-term or future value. Without government regulation, a factory owner can feel free to pollute the air or water, since he or she will have no responsibility for the pollution once the winds or waves carry it somewhere else. Without government regulation, someone can hunt all the migratory birds or deplete a fishery by taking all the fish, eliminating future breeding stocks that would maintain the population. The situation in which individuals exhaust a common resource by acting in their own immediate self-interest is called the tragedy of the commons.

A second problem with strict adherence to free-market economics is that some goods are too large, or too expensive, for individuals to provide them for themselves. Consider the need for a marketplace: Where does the marketplace come from? How do we get the goods to market? Who provides the roads and bridges? Who patrols the waterways? Who provides security? Who ensures the regulation of the currency? No individual buyer or seller could accomplish this. The very nature of the exchange of private goods requires a system that has some of the openness of public or common goods, but is maintained by either groups of individuals or entire societies.

Economists consider goods like cable TV, cellphone service, and private schools to be toll goods. Toll goods are similar to public goods in that they are open to all and theoretically infinite if maintained, but they are paid for or provided by some outside (nongovernment) entity. Many people can make use of them, but only if they can pay the price. The name “toll goods” comes from the fact that, early on, many toll roads were in fact privately owned commodities. Even today, states from Virginia to California have allowed private companies to build public roads in exchange for the right to profit by charging tolls.[1]

So long as land was plentiful, and most people in the United States lived a largely rural subsistence lifestyle, the difference between private, public, common, and toll goods was mostly academic. But as public lands increasingly became private through sale and settlement, and as industrialization and the rise of mass production allowed monopolies and oligopolies to become more influential, support for public policies regulating private entities grew. By the beginning of the twentieth century, led by the Progressives, the United States had begun to search for ways to govern large businesses that had managed to distort market forces by monopolizing the supply of goods. And, largely as a result of the Great Depression, people wanted ways of developing and protecting public goods that were fairer and more equitable than had existed before. These forces and events led to the increased regulation of public and common goods, and a move for the public sector—the government—to take over of the provision of many toll goods.

CLASSIC TYPES OF POLICY

Public policy, then, ultimately boils down to determining the distribution, allocation, and enjoyment of public, common, and toll goods within a society. While the specifics of policy often depend on the circumstances, two broad questions all policymakers must consider are a) who pays the costs of creating and maintaining the goods, and b) who receives the benefits of the goods? When private goods are bought and sold in a market place, the costs and benefits go to the participants in the transaction. Your landlord benefits from receipt of the rent you pay, and you benefit by having a place to live. But non-private goods like roads, waterways, and national parks are controlled and regulated by someone other than the owners, allowing policymakers to make decisions about who pays and who benefits.

In 1964, Theodore Lowi argued that it was possible to categorize policy based upon the degree to which costs and benefits were concentrated on the few or diffused across the many. One policy category, known as distributive policy, tends to collect payments or resources from many but concentrates direct benefits on relatively few. Highways are often developed through distributive policy. Distributive policy is also common when society feels there is a social benefit to individuals obtaining private goods such as higher education that offer long-term benefits, but the upfront cost may be too high for the average citizen.

One example of the way distributive policy works is the story of the Transcontinental Railroad. In the 1860s, the U.S. government began to recognize the value of building a robust railroad system to move passengers and freight around the country. A particular goal was connecting California and the other western territories acquired during the 1840s war with Mexico to the rest of the country. The problem was that constructing a nationwide railroad system was a costly and risky proposition. To build and support continuous rail lines, private investors would need to gain access to tens of thousands of miles of land, some of which might be owned by private citizens. The solution was to charter two private corporations—the Central Pacific and Union Pacific Railroads—and provide them with resources and land grants to facilitate the construction of the railroads.[2] Through these grants, publicly owned land was distributed to private citizens, who could then use it for their own gain. However, a broader public gain was simultaneously being provided in the form of a nationwide transportation network.

The same process operates in the agricultural sector, where various federal programs help farmers and food producers through price supports and crop insurance, among other forms of assistance. These programs help individual farmers and agriculture companies stay afloat and realize consistent profits. They also achieve the broader goal of providing plenty of sustenance for the people of the United States, so that few of us have to “live off the land.”

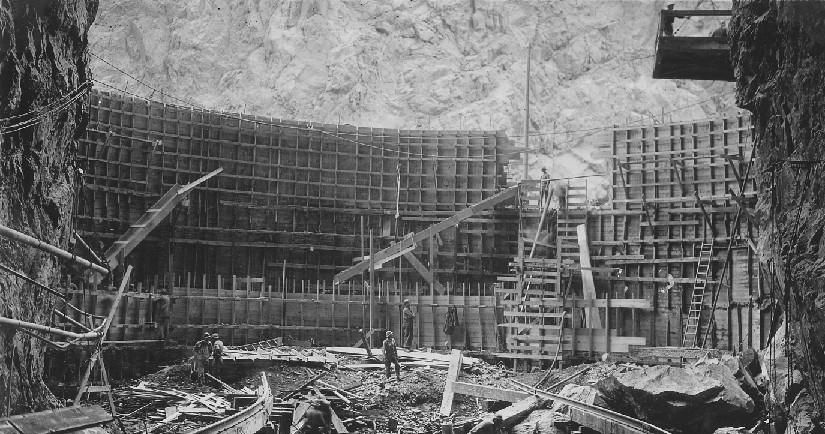

The Hoover Dam: The Federal Effort to Domesticate the Colorado River

As westward expansion led to development of the American Southwest, settlers increasingly realized that they needed a way to control the frequent floods and droughts that made agriculture difficult in the region. As early as 1890, land speculators had tried diverting the Colorado River for this purpose, but it wasn’t until 1922 that the U.S. Bureau of Reclamation (then called the Reclamation Service) chose the Black Canyon as a good location for a dam to divert the river. Since it would affect seven states (as well as Mexico), the federal government took the lead on the project, which eventually cost $49 million and more than one hundred lives. The dam faced significant opposition from members of other states, who felt its massive price tag (almost $670 million in today’s dollars[3]) benefitted only a small group, not the whole nation. However, in 1928, Senator Hiram Johnson and Representative Phil Swing, both Republicans from California, won the day. Congress passed the Boulder Canyon Project Act, authorizing the construction of one of the most ambitious engineering feats in U.S. history. The Hoover Dam, completed in 1935, served the dual purposed of generating hydroelectric power and irrigating two million acres of land from the resulting reservoir (Lake Mead).

Was the construction of the Hoover Dam an effective expression of public policy? Why or why not?

link to learning

American Rivers is an advocacy group whose goal is to protect and restore rivers, including the Colorado River. How does this group’s view of the Hoover Dam differ from that of the USBR?

Other examples of distributive policy support citizens’ efforts to achieve “the American Dream.” American society recognizes the benefits of having citizens who are financially invested in the country’s future. Among the best ways to encourage this investment are to ensure that citizens are highly educated and have the ability to acquire high-cost private goods such as homes and businesses. However, very few people have the savings necessary to pay upfront for a college education, a first home purchase, or the start-up costs of a business. To help out, the government has created a range of incentives that everyone in the country pays for through taxes but that directly benefit only the recipients. Examples include grants (such as Pell grants), tax credits and deductions, and subsidized or federally guaranteed loans. Each of these programs aims to achieve a policy outcome. Pell grants exist to help students graduate from college, whereas Federal Housing Administration mortgage loans lead to home ownership.

While distributive policy, according to Lowi, has diffuse costs and concentrated benefits, regulatory policy features the opposite arrangement, with concentrated costs and diffuse benefits. A relatively small number of groups or individuals bear the costs of regulatory policy, but its benefits are expected to be distributed broadly across society. As you might imagine, regulatory policy is most effective for controlling or protecting public or common resources. Among the best-known examples are policies designed to protect public health and safety, and the environment. These regulatory policies prevent manufacturers or businesses from maximizing their profits by excessively polluting the air or water, selling products they know to be harmful, or compromising the health of their employees during production.

In the United States, nationwide calls for a more robust regulatory policy first grew loud around the turn of the twentieth century and the dawn of the Industrial Age. Investigative journalists—called muckrakers by politicians and business leaders who were the focus of their investigations—began to expose many of the ways in which manufacturers were abusing the public trust. Although various forms of corruption topped the list of abuses, among the most famous muckraker exposés was The Jungle, a 1906 novel by Upton Sinclair that focused on unsanitary working conditions and unsavory business practices in the meat-packing industry.[4] This work and others like it helped to spur the passage of the Pure Food and Drug Act (1906) and ultimately led to the creation of government agencies such as the U.S. Food and Drug Administration (FDA).[5] The nation’s experiences during the depression of 1896 and the Great Depression of the 1930s also led to more robust regulatory policies designed to improve the transparency of financial markets and prevent monopolies from forming.

A final type of policy is redistributive policy, so named because it redistributes resources in society from one group to another. That is, according to Lowi, the costs are concentrated and so are the benefits, but different groups bear the costs and enjoy the benefits. Most redistributive policies are intended to have a sort of “Robin Hood” effect; their goal is to transfer income and wealth from one group to another such that everyone enjoys at least a minimal standard of living. Typically, the wealthy and middle class pay into the federal tax base, which then funds need-based programs that support low-income individuals and families. A few examples of redistributive policies are Head Start (education), Medicaid (health care), Temporary Assistance for Needy Families (TANF, income support), and food programs like the Supplementary Nutritional Aid Program (SNAP). The government also uses redistribution to incentivize specific behaviors or aid small groups of people. Pell grants to encourage college attendance and tax credits to encourage home ownership are other examples of redistribution.

Summary

Goods are the commodities, services, and systems that satisfy people’s wants or needs. Private goods can be owned by a particular person or group, and are excluded from use by others, typically by means of a price. Free-market economists believe that the government has no role in regulating the exchange of private goods because the market will regulate itself. Public goods, on the other hand, are goods like air, water, wildlife, and forests that no one owns, so no one has responsibility for them. Most people agree the government has some role to play in regulating public goods.

We categorize policy based upon the degree to which costs and benefits are concentrated on the few or diffused across the many. Distributive policy collects from the many and benefits the few, whereas regulatory policy focuses costs on one group while benefitting larger society. Redistributive policy shares the wealth and income of some groups with others.

Try It

think it over

- Of the types of goods introduced in this section, which do you feel is the most important to the public generally and why? Which public policies are most important and why?

- Distributive Policy

- a policy that collect payments or resources broadly but concentrates direct benefits on relatively few

- Free-Market Economics

- a school of thought that believes the forces of supply and demand, working without any government intervention, are the most effective way for markets to operate

- Libertarians

- people who believe that government almost always operates less efficiently than the private sector and that its actions should be kept to a minimum

- Redistributive Policy

- a policy in which costs are born by a relatively small number of groups or individuals, but benefits are expected to be enjoyed by a different group in society

- Regulatory Policy

- a policy that regulates companies and organizations in a way that protects the public

glossary

- David Mildenberg, "Private Toll Road Investors Shift Revenue Risk to States," 26 November 2013. http://www.bloomberg.com/news/articles/2013-11-27/private-toll-road-investors-shift-revenue-risk-to-states (March 1, 2016). ↵

- http://www.history.com/topics/inventions/transcontinental-railroad (March 1, 2016). ↵

- http://www.dollartimes.com/inflation/inflation.php?amount=49&year=1919 (March 1, 2016). ↵

- Upton Sinclair. 1906. The Jungle. New York: Grosset and Dunlap. ↵

- http://www.fda.gov/AboutFDA/WhatWeDo/History/ (March 1, 2016). ↵